reit dividend tax south africa

Posted 2 August 2015 under Tax QA Peter says. The SA REIT Association is the representative of SAs listed REIT industry.

South Africa Reits Investing Offshore International Tax Review

The rate of Dividends Tax increased from 15 to 20 for any dividend paid on or after 22 February 2017 irrespective of declaration date unless an exemption or reduced rate is applicable.

. The foreign tax will have to be shown to be a tax on income that is substantially similar to a tax in terms of a South African. This creates an issue that individual investors in REITs are not able to receive the benefit of the reduction in the corporate income tax rate due to the type of company they are invested in. Its members include all 30 listed SA REITs with a combined market capitalization of around R300bn.

A reduced dividend withholding rate in terms of the. Do Your Tax Return Easily. South African REITs own several kindof commercial s such asproperty shopping centres office buildings factories warehouses hotels hospitals and residential.

Over 160 Million Net Dividends Earned By Investors Since 2014. Ad With negative real bond yields here is how you can invest for passive income right now. Foreign shareholders of SA REITs are levied a dividend withholding post tax at the current rate of 20 but this can be reduced in terms of the rates set by the applicable double tax agreement between South Africa and the domiciled country of the investor.

Property owning subsidiaries of REITs also benefit from the section 25BB tax dispensation. A REIT stands for Real Estate Investment Trust. 1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total nett REIT dividends for period R3709.

58 of 1962 the Act pertaining to the taxation of Real Estate Investment Trusts REITs are contained in section 25BB and were introduced into the Act with effect from 1 April 2013. Ad Access Real Estates Historically Consistent Return Potential With Fundrise. Interest distributions by a REIT or a controlled property company payable to South African resident investors are recharacterised as taxable dividends ie the normal tax exemption for dividends does not apply but dividends withholding taxes will not apply.

TaxTim will help you. Received by a non-resident from a REIT will be subject to dividend withholding tax at 15 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation DTA between South Africa and the country of residence of the unitholder. Top Performing REITs in South Africa.

Reit Dividends Tax. Cape Town South Africa Site secured by Comodo Security. Any REIT dividend excluding a share buy-back from a company that is a REIT at the time of the distribution of that dividend but including interest paid on a debenture forming part of a linked unit held in a REIT.

Section 25BB is quoted in the. Be subject to a 20 dividends tax which is in fact a tax on the investor. The participation exemption exempts foreign dividends and capital gains from tax in South Africa provided that the South African taxpayer holds at least 10 of the total equity shares and voting rights in the foreign company declaring the foreign dividend or at least 10 of the total equity shares in the foreign company subject to the disposal.

Submit your tax return right here. The property company will be more efficient in tax planning because the tax is paid in your brokerage account and not by the investor. STC was payable by South African resident companies at a rate of 10 on dividends declared on or before 31 March 2012.

Deduction of qualifying distributions. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income producing real estate assets. As from 1 April 2012 dividends tax is charged at 15 on shareholders when dividends are paid to them by a South African tax resident company or Foreign Company whose shares are listed on the JSE.

In South Africa a REIT receives special tax considerations and offers investors exposure to real estate through shares listed on the Johannesburg Stock Exchange JSE. Tax consequences for REITs. Such person will however be exempt from dividends tax in respect of such dividend.

Each of these 3 companies pays around 10 to its shareholders annually. Recharacterisation of interest distributions. A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued from a REIT at a maximum rate of 40.

Dividend holding tax has not been taken off. As of 1 January 2014 the SA dividend withholding tax at 15 or the treaty governed rate where the investor is. REIT Dividends - South African tax resident shareholders.

This is a listed property investment vehicle. To qualify for the South African REIT dispensation a the REIT either a company or a trust must be tax resident in South Africa and be listed as an REIT in terms of the JSE Johannesburg Stock Exchange listing requirements. The REIT regime in South Africa aims to create a flow though vehicle for income tax purposes.

However dividends or qualifying distributions that the REIT declares and pays to its investors are generally limited to actual cash the REIT or CC has earned and therefore the REIT or CC would exclude unrealised forex. 2 days agoAny dividend received by a non- resident from a REIT is subject to dividend tax at 20 unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation agreements DTA between South Africa and the country of residence of the non- resident shareholders. A fundamental part of the regime relates to the ability of the REIT and its subsidiaries to deduct for income tax purposes dividends declared and paid to their immediate shareholders.

A REIT is a resident company which shares are listed on an exchange as shares. A REIT and a controlled company must also consider dividends tax transfer duty securities transfer tax and VAT. A summary of the withholding tax rates as per the South African Double Taxation Agreements currently in force has been split into two parts Africa and the.

The provisions in the Income Tax Act No. Ignoring commercial considerations in relation to this fairly common occurrence often the shareholders of the target company in these circumstances would be motivated for income tax reasons to rather sell the shares in the target company to the REIT as opposed to a sale by the target company of each of the immovable properties which may inter alia attract. REIT Dividends received by South African tax residents must be included in their gross income and will not be exempt from income tax in terms of the exclusion to the general dividend exemption contained in paragraph aa of section 101ki of the Income Tax Act because they are dividends.

Tax consequences for REITs of foreign exchange movements COVID-19 South Africa. Distributions from REITs must be included in the taxpayers taxable income and will be taxed per their marginal tax rate.

South Africa Reits Investing Offshore International Tax Review

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Taxation Of Real Estate Investment Vehicles Reit Or Controlled Company

Analysis Reit South African Real Estate Investment Trust Structure Introduced Accountancy Sa

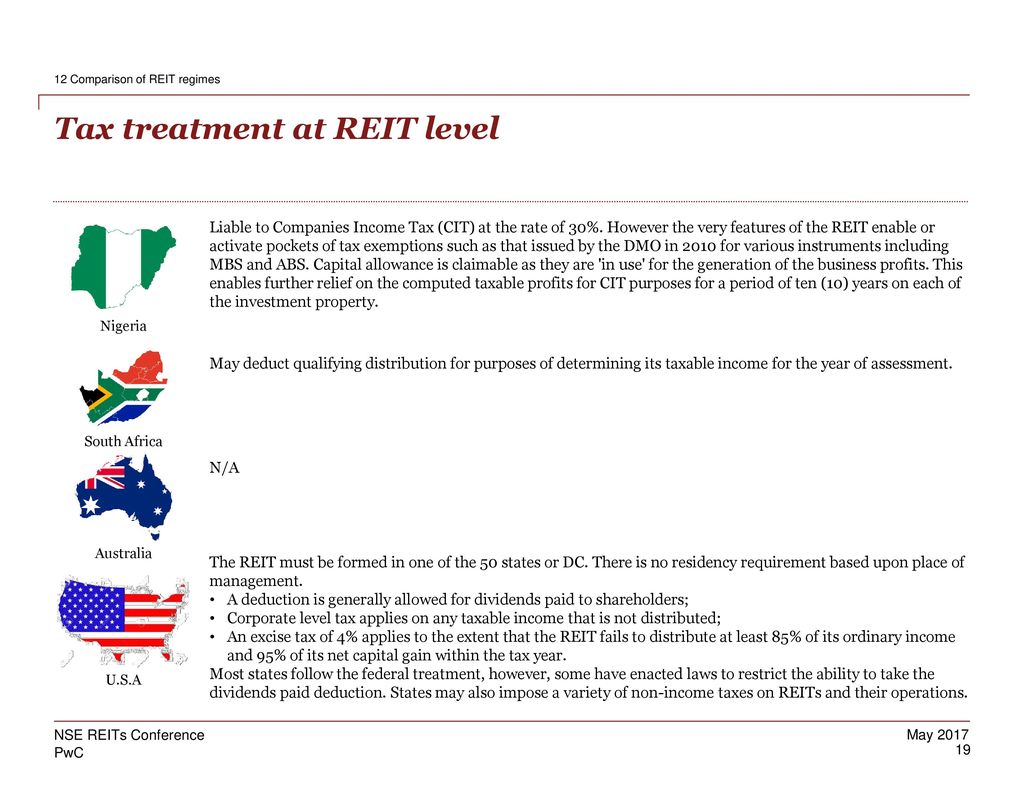

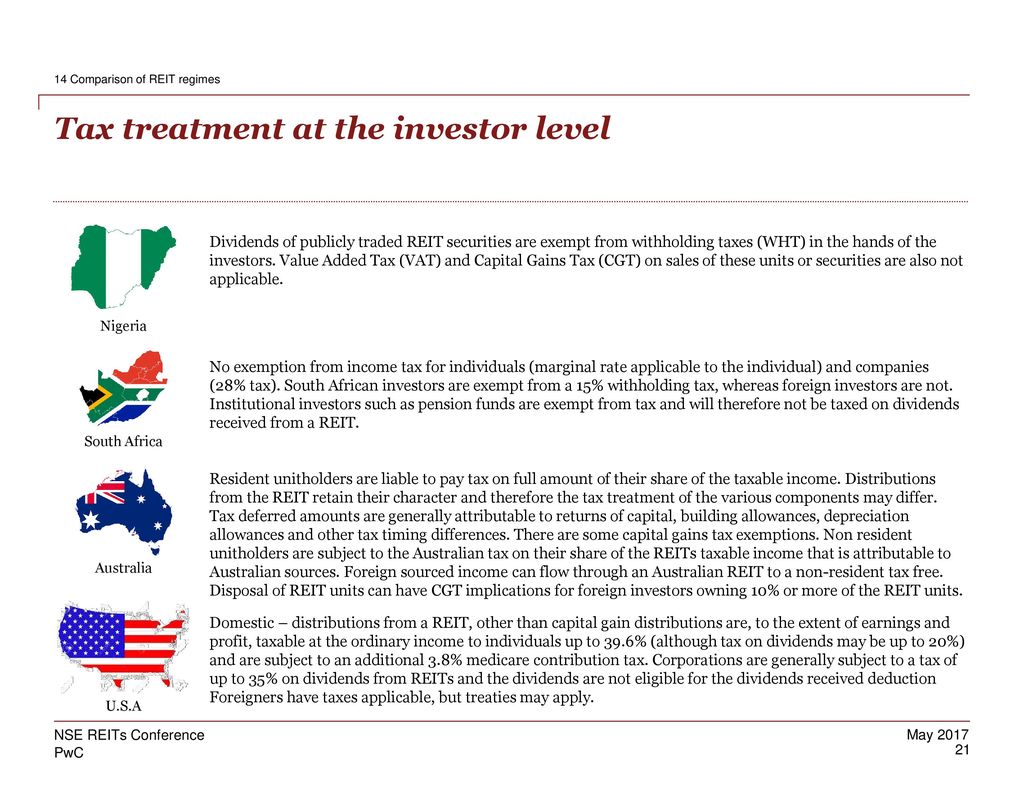

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

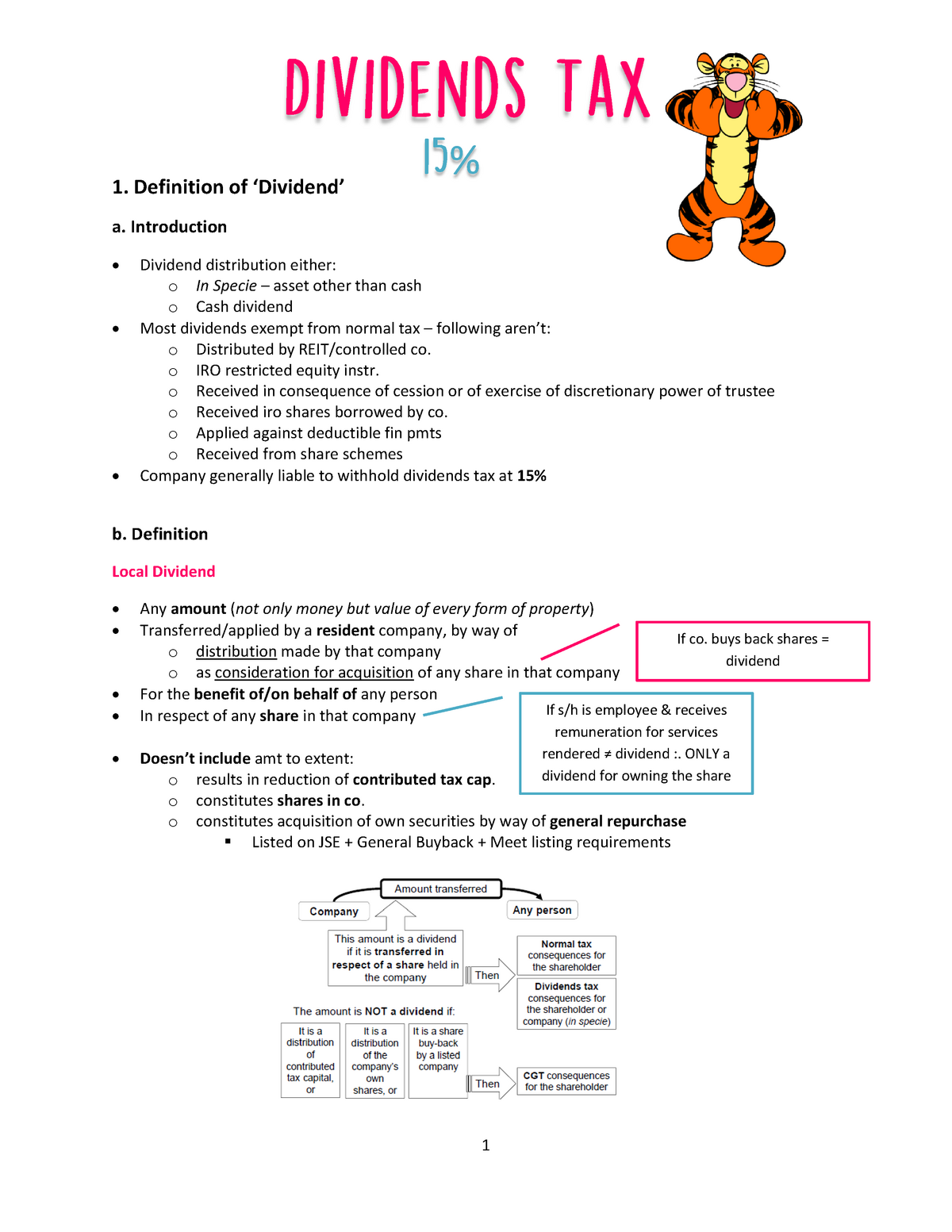

Dividends Tax Notes 1 Definition Of Dividend A Introduction Dividend Distribution Either O Studocu

Sa Reits Tax Benefits For Investors Sa Reit

Sa Reits Tax Benefits For Investors Sa Reit

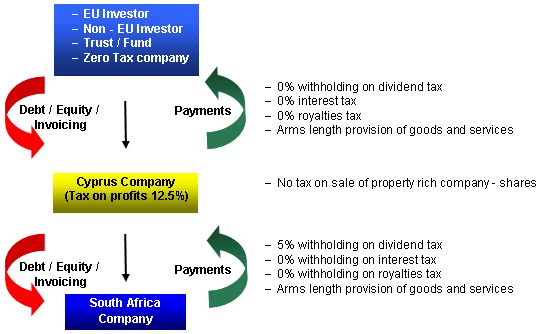

Structuring Investments In From South Africa Through Cyprus Tax Treaties Cyprus

Real Estate Investors Face Dividend Drought

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

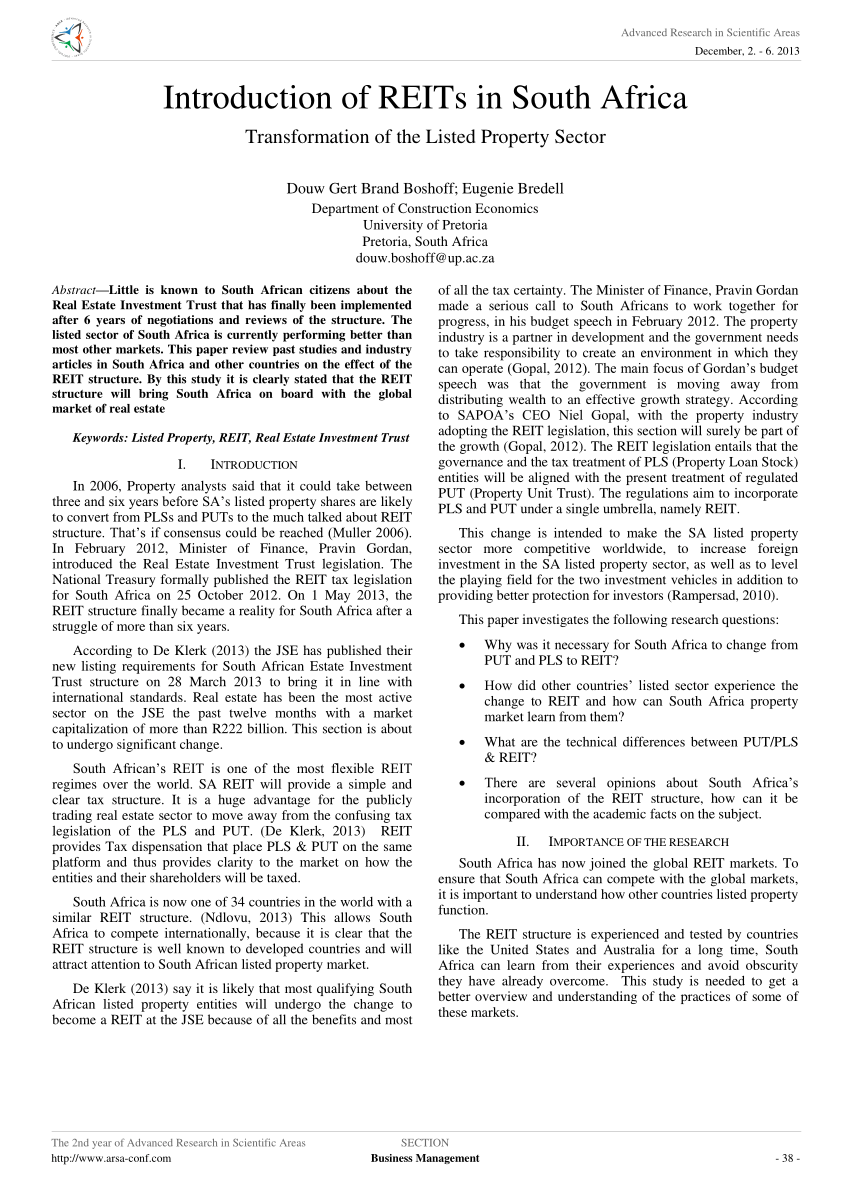

Pdf Introduction Of Reits In South Africa Transformation Of The Listed Property Sector

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

Quarterly Dividends Unrestricted Model Download Table

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download